Get local insights relevant to your area of specialization, learn what others have done in your industry and leverage their experience. If you would like to explore further how Near can help you outsource your accounts payable roles the differences in wages payable wages expense to professionals in LatAm, book a free consultation call today. Businesses should establish clear communication channels and expectations with their outsourcing provider from the outset to address communication challenges.

- Tax planning is a crucial aspect for client, spend your time with Tax Planning and outsource Tax Preparation to us.

- If you’re communicating clearly with a trustworthy partner, this doesn’t need to be a negative.

- When deliberating whether to outsource, one crucial factor to ponder is your staffing capacity.

What are accounts payable services?

You never know what kind of deal breakers might only come up once you get a closer look at a given provider, so “due diligence” is the phrase to live by here. Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. Use the information and tips shared in this guide to effectively outsource F&A functions and get the maximum benefit out of it. We can’t overstate the importance of analyzing your accounting needs before making an outsourcing decision.

Outsourced accounting: benefits, types, and getting started

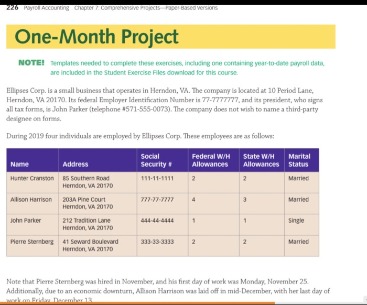

In administrative terms It involves calculating wages, withholding taxes and other deductions, and issuing payslips. If you’re a small business that manages its own books, you could be spending your time and resources elsewhere. https://www.kelleysbookkeeping.com/what-are-the-different-types-of-accounting-systems-options-explained/ If you’re hiring across borders, you’ll have to recruit in-house accountants in all the countries you’re onboarding in. This can be costly and complex, especially if you don’t have legal entities in those countries.

Specialized Accounting Services

To help you start your search, we’ve listed our recommendations for the top three companies offering accounts payable outsourcing. Each of these companies offers a unique set of services and solutions to help streamline your accounts payable processes and improve overall efficiency. A provider built specifically to meet the needs of smaller organizations, Bench Accounting’s outsourced bookkeeping services can completely replace your current process or software tools. And with a one-month free trial, you can test drive their offerings before fully committing. Accounts payable outsourcing is the strategic delegation of a company’s AP functions to external specialists, optimizing efficiency and accuracy. Along with offering the typical outsourced bookkeeping services, AccountingDepartment.com provides outsourced controller services.

Accounts Payable Outsourcing involves handing over AP tasks to an external service provider. This approach offers comprehensive management of AP processes, from invoice processing to payment disbursement, leveraging the provider’s expertise, technology, and resources. It’s ideal for businesses seeking end-to-end management without the need to invest in additional technology or personnel. By evaluating potential providers’ capabilities, assessing cost and value, and verifying security and compliance measures, you can select the best accounts payable service provider for your business needs. With the right partner in place, your organization can unlock the potential of accounts payable outsourcing and drive the success of your financial operations.

Change how finance works by orchestrating the right combination of human and machine talent and drawing on data and insights. Seamlessly hire global talent and teams via our vetted freelancers, traditional outsourcing, and direct placement–all while staying 100% compliant. Unearned revenue may be a liability on the books but it does have many benefits for small business owners. RSM’s cloud-based FAO platform is easy, scalable and technologically powerful, providing real-time information in dashboard format for clear decision-making.

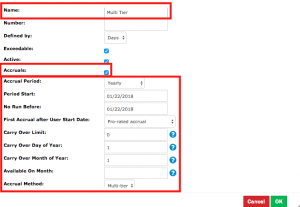

Before hiring an outsourced team, it’s vital to outline the necessary support and services, such as bookkeeping, reporting, payroll taxes, tax returns, transaction fee monitoring, etc. A reliable financial management service https://www.wave-accounting.net/ provider will collaborate with you to understand your unique business requirements and modify their services to match them. This flexibility ensures you get value for your money by only paying for what you need.

This ensures that your tax and legal obligations are being handled by local accountants who understand local tax laws and regulations, and who are sufficiently qualified. Intended to automate the majority of both your bookkeeping efforts as well as your tax preparation, 1-800Accountant turns a major hassle into a huge relief. With a dedicated accountant assigned to help you get your records in shape, the service maintains your finances and prepares your taxes simultaneously. At year end, tax prep is virtually effortless because they already have all of the information in hand.

Ensuring precise financial reporting for defence contractors with our contract compliance accounting solutions. Elevate the guest experience by optimizing financial operations in hospitality with our revenue management tools. However, due to its strategic locations, Bulgarian outsourcing services can also serve clients from Turkey, Middle East, and North Africa. India is undoubtedly a global outsourcing powerhouse, catering to various domains, including accounting and finance. Accounting and finance systems that leverage advanced technology can give you an edge over your competitors. If you can’t afford to invest in such technology, you can opt for an external provider that already has such systems in place.

Companies that don’t adopt the automation trend may encounter miscommunication, disorganization, slow processes, and increased staff involvement that could lead to burnout. Ultimately, all this may veer you away from your core function and lead to increased operational costs. Machine learning and artificial intelligence are also important trends in finance and accounting.